1099 hourly rate to salary calculator

Next divide this number from the annual salary. In order to calculate an hourly rate based upon your monthly salary multiply your monthly figure by 12 and then divide it by the number of hours you work per week.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720.

. Hourly wage to yearly salary. Note your hourly rate before was 50k2040 or 2451 so this is 43 higher. You can factor in paid.

30 8 260 62400. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. Ad Create professional looking paystubs.

What to know about Form 1099-NEC plus when to use it and what happens to Form 1099-MISC. To calculate hourly salary to hourly wage we use a formula. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate.

Time Worked Hours Per Day Days Per Week Hourly Pay Exclude un-paid time Computed Pay Yearly Pay Exclude un-paid time 3000 dollars hourly including un-paid time is 6240000 dollars yearly including un-paid time. Online calculator should tell you taxes are 9134. In order to calculate an hourly rate based upon your monthly salary multiply your monthly figure by 12 and then divide it by the number of hours you work per week.

If an employee makes 80000 the hourly rate is 3846 per hour. Full-time salary burden 2080 contract hourly rate Calculate Your Pay Income Calculation Method Hourly Rate Overtime Rate. We use the most recent and accurate information.

For example the employee sees that their hourly rate is 20 per hour. Annual Salary Hourly Wage Hours per workweek 52 weeks. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720.

To convert your hourly wage to its equivalent salary use our calculator below. How do I calculate taxes from paycheck. Consultants can also use this wage calculator to convert.

Consultants can also use this salary calculator to convert hourly rate to salary or annual income. Use this calculator to easily convert a salary to an hourly rate and the corresponding daily wage monthly. States dont impose their own income tax for tax year 2022.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. How Much do I Make a Year Calculator - convert hourly wage to annual salary. This is a great exercise to come up with a target hourly rate that you can use to start negotiations with a client.

Explore your next job opportunity on Indeed Find jobs. Hourly To Salary Calculator. Form Quickly and Easily.

In a few easy steps you can create your own paystubs and have them sent to your email. Need help calculating paychecks. So good - you net the same per year with 68500.

Visit to see yearly monthly weekly and daily pay tables and graphs. With W-2 designated employees businesses are required by law to cover employer taxes roughly a 15 markup on salary depending on where the employee lives and organization is registered. Sometimes hiring an independent contractor or 1099 worker is a more economical choice for an employer looking to get work done on a lean budget.

This equation takes burden into account. W-2 hourly rate difference is rarely so simple when an employees annual salary and benefits package are also factors. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as.

Hourly Monthly salary 12 Hours per week Weeks per year. Federal income tax rates range from 10 up to a top marginal rate of 37. To calculate the hourly rate on the basis of your monthly salary firstly multiply your monthly salary by 12.

Adjusting- 91hr08 114hr on 1099 We have put together a calculator you can use here to calculate your personal hourly rate. Salary calculator - hourly to annual. Of course knowing the 1099 vs.

1 Create Your 1099 Form For Free In Minutes. Monthly Salary Annual Salary 12. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is not an exact calculation of your taxes because many other factors outside the scope of this comparison can affect your tax situation.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. The see that they earn 204052 or 41600 per year. Add that to SE taxes and youre at 18813 total taxes or a take-home of 49687.

Get A Free Trial. W-2 Pay Difference Calculator for Salary and Benefits. Employee Income Estimate your W2 income for the whole year Work mileage Estimate the number of miles you drive for work for the whole year miles.

There is in depth information on how to estimate salary earnings per each period below the form. Median household income in 2020 was 67340. 1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any employee jobs.

This forum from The Workplace Stack. This calculator uses the 2019 withholding schedules rules and rates IRS Publication 15. For a long-term contract on 1099 status the calculations are a little different.

You can generally lower your rate for longer term contracts as your utilization rate will increase. In the Weekly hours field enter the number of hours you do each week excluding any overtime. Quarterly Salary Annual Salary 4.

Ad Facts all tax pros need to know about fom 1099-NEC for non-employee compensation. In the United States the rule of thumb is that salary pay rate that the employee sees only represents about half of the rate the employer has to charge a customer for their time. Ad Create Edit and Export Your 1099 Misc.

To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885 Weekly paycheck to hourly rate 1500 per week 40 hours per week 3750 per hour Daily wage to hourly rate 120 per day 8 hours 15 per hour Salary range. 2Enter the Hourly rate without the dollar sign.

For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. 2 File Online Print Instantly.

Divide that gross number by hours worked 1960 and you get 3495hr. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Divide this resulting figure by the number of paid weeks you work each year to get your hourly rate.

If you make 20 an hour you make approximately 40000 a year. A 1099 contractor making 35hour would then expect to make about 3250hour 3510765.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Tax On Pay Calculator Factory Sale 58 Off Www Wtashows Com

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Salary To Hourly Salary Converter Salary Hour Calculators

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Payroll Calculator Free Employee Payroll Template For Excel

Tax On Pay Calculator Factory Sale 58 Off Www Wtashows Com

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Templates Professional Templates

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Payment Calculator Online 52 Off Www Wtashows Com

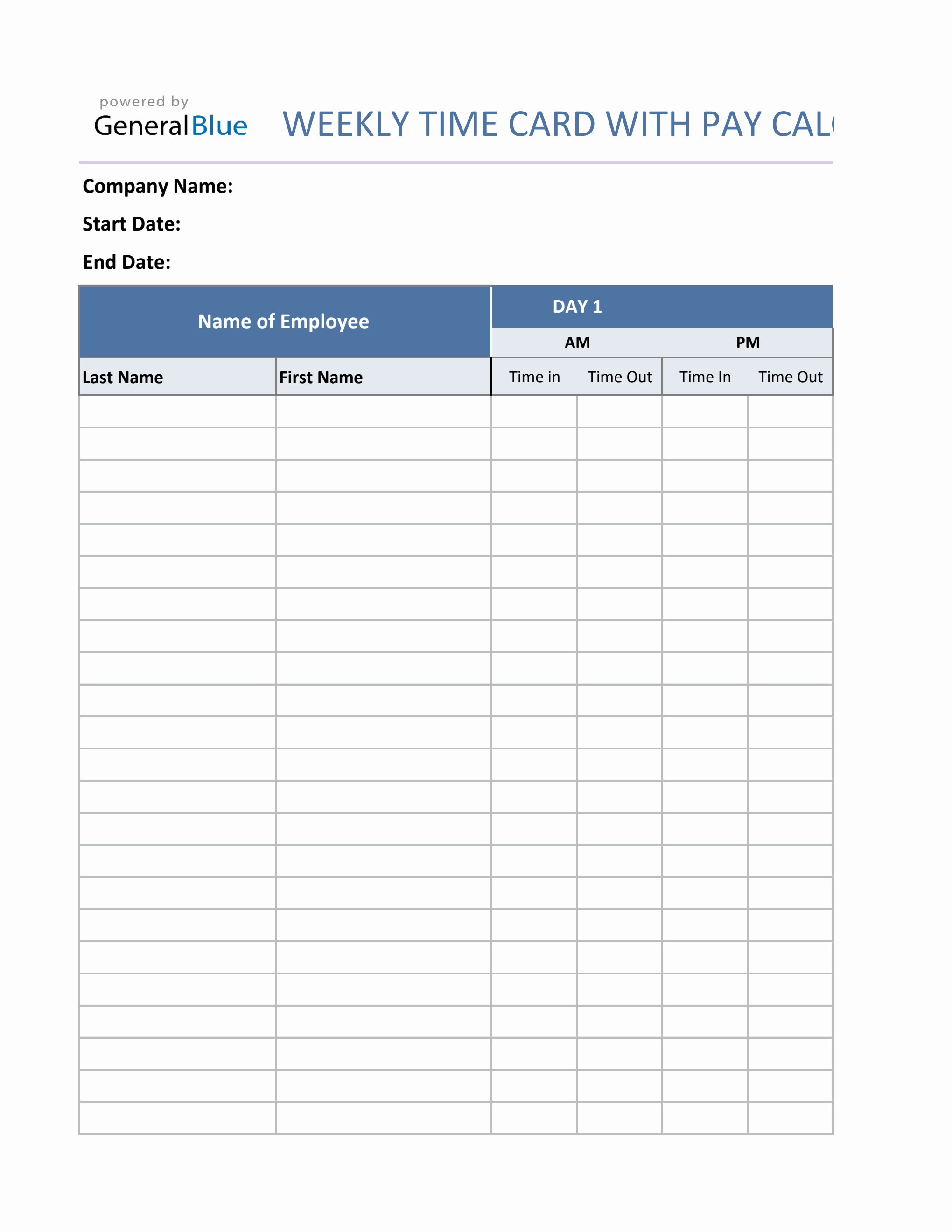

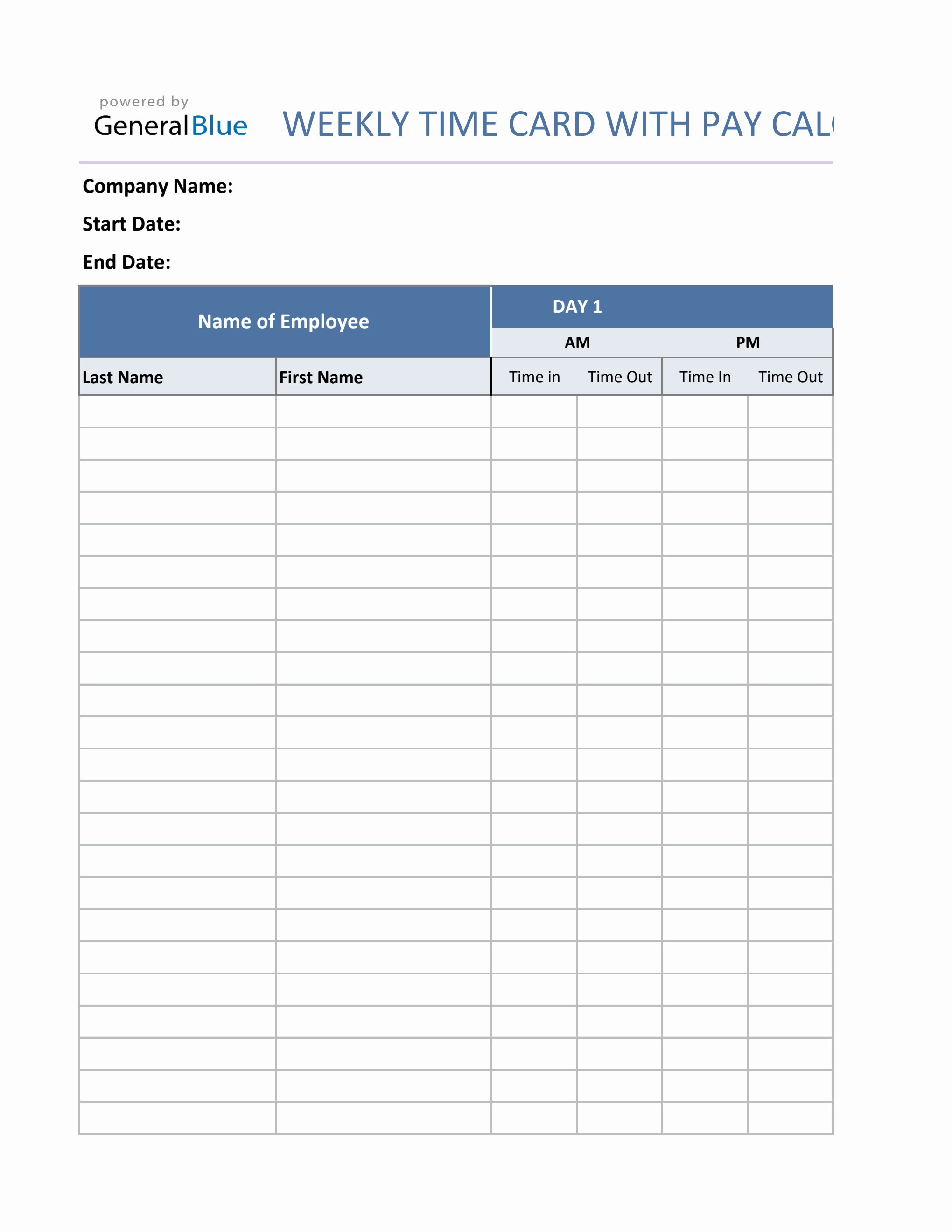

Weekly Timecard With Pay Calculation For Contractors In Excel

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How To Calculate Your 1099 Hourly Rate No Matter What You Do